Investing in Liquefied Natural Gas (LNG) Stocks: A Lucrative Opportunity in the Energy Sector

Introduction

In recent years, the demand for cleaner energy sources has been on the rise, leading to a significant shift towards natural gas as an alternative to traditional fossil fuels. One particular segment within the natural gas industry that has gained prominence is Liquefied Natural Gas (LNG). This blog post aims to provide you with a comprehensive overview of LNG stocks as an investment opportunity, highlighting their potential benefits, risks, and key factors to consider before making an investment decision.

See More What Is The Lng Collection

Table of Contents

- Understanding Liquefied Natural Gas (LNG)

- Why Invest in LNG Stocks?

- Factors to Consider Before Investing in LNG Stocks

- Global Demand and Supply Dynamics

- Regulatory Environment and Political Factors

- Company-Specific Factors

- Top Liquefied Natural Gas Stocks to Consider

- Company A

- Company B

- Company C

- Risks Associated with LNG Stocks

- Volatility in Commodity Prices

- Geopolitical Risks

- Environmental Concerns

- How to Invest in LNG Stocks

- Individual Stocks

- Exchange-Traded Funds (ETFs)

- Conclusion

1. Understanding Liquefied Natural Gas (LNG)

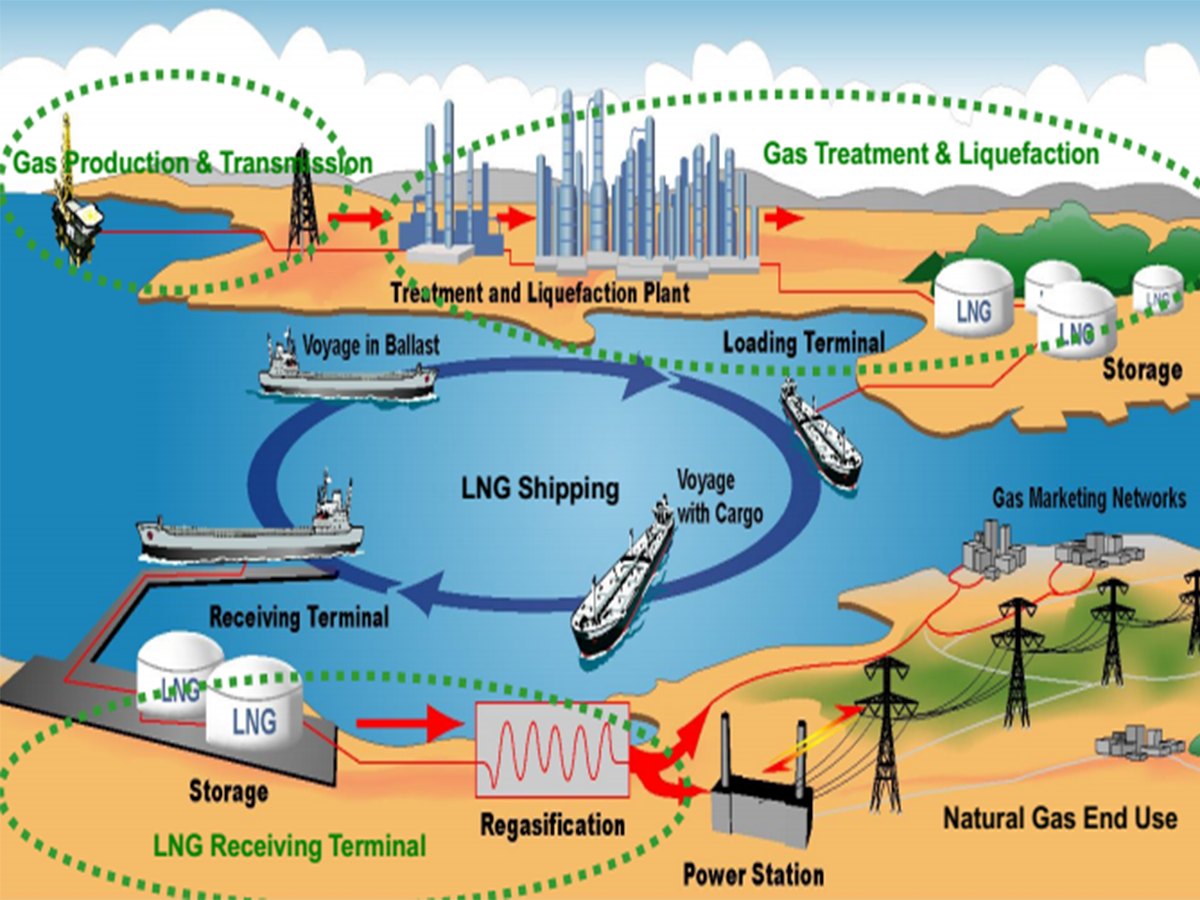

Liquefied Natural Gas (LNG) is natural gas that has been cooled to a liquid state at around -260°F (-162°C) to facilitate storage and transportation. By cooling the gas, it reduces its volume by approximately 600 times, making it more practical to transport over long distances via specially designed LNG tankers.

More About Us: SOUTHERN GAS TRADING JSC

2. Why Invest in LNG Stocks?

Investing in LNG stocks can offer several advantages for investors looking to diversify their portfolios and tap into the growing demand for cleaner energy sources. Here are some key reasons to consider investing in LNG stocks:

a. Increasing Global Demand for Natural Gas

The demand for natural gas has been steadily rising due to its lower carbon emissions compared to other fossil fuels like coal and oil. As countries worldwide aim to reduce greenhouse gas emissions, the transition to natural gas becomes a crucial part of their energy policies.

b. Expanding Global LNG Infrastructure

Numerous countries are investing heavily in building LNG import and export terminals, creating a robust infrastructure for the global trade of LNG. This expansion opens up new markets and trading opportunities for LNG producers and exporters.

c. Potential for Long-Term Growth

The long-term outlook for LNG stocks appears promising, driven by factors such as increasing demand, favorable pricing dynamics, and technological advancements in extraction and liquefaction processes.

3. Factors to Consider Before Investing in LNG Stocks

Before investing in LNG stocks, it's essential to consider various factors that can influence the performance of these stocks. Here are some key factors to evaluate:

a. Global Demand and Supply Dynamics

Understanding the demand and supply dynamics of LNG on a global scale is crucial for assessing the potential profitability of investments in LNG stocks. Factors such as population growth, economic development, and geopolitical events can impact the demand for LNG.

b. Regulatory Environment and Political Factors

LNG projects often require significant regulatory approvals due to safety concerns and environmental impact. Investors should assess the regulatory framework and political stability of regions where LNG companies operate, as changes in regulations or political instability can affect operations and profitability.

c. Company-Specific Factors

Analyzing the financial health, competitive advantages, management team, and growth prospects of individual LNG companies is vital when considering an investment. Evaluating factors like proven reserves, production capacity, and existing customer contracts can provide valuable insights into a company's potential for future growth.

4. Top Liquefied Natural Gas Stocks to Consider

When considering investing in LNG stocks, it's crucial to identify well-established companies with strong track records and growth potential. Here are three companies worth considering:

a. Company A

Company A is a global leader in the LNG industry, with a diverse portfolio of liquefaction plants and strong partnerships with key customers worldwide. With a proven track record of operational excellence and a robust balance sheet, Company A is well-positioned to capitalize on the growing demand for LNG.

b. Company B

Company B is an emerging player in the LNG sector, focusing on developing innovative liquefaction technologies and expanding its footprint in strategic markets. Despite being relatively new, Company B has shown remarkable growth potential and has secured long-term contracts with major buyers.

c. Company C

Company C is a vertically integrated LNG company involved in all aspects of the LNG value chain, from production and liquefaction to shipping and regasification. With a diverse asset base and a strong presence in both established and emerging markets, Company C offers investors exposure to various stages of the LNG industry.

5. Risks Associated with LNG Stocks

Investing in LNG stocks comes with certain risks that investors should be aware of. Here are some key risks associated with these investments:

a. Volatility in Commodity Prices

LNG prices are influenced by various factors such as supply-demand imbalances, changes in global natural gas prices, and geopolitical events. These price fluctuations can impact the profitability of LNG companies and subsequently affect their stock prices.

b. Geopolitical Risks

The global nature of the LNG industry exposes it to geopolitical risks such as trade disputes, sanctions, political instability, and regional conflicts. Any adverse political or economic developments in major LNG-producing regions can disrupt supply chains and impact company operations.

c. Environmental Concerns

While natural gas is considered a cleaner alternative to other fossil fuels, concerns about methane emissions during extraction and transportation remain. Investors should consider the environmental implications of supporting the expansion of the LNG industry when making investment decisions.

6. How to Invest in LNG Stocks

Investors interested in gaining exposure to the LNG sector have multiple options to consider:

a. Individual Stocks

Investing directly in individual LNG companies allows investors to handpick specific stocks based on their research and analysis. This approach requires diligent research into each company's financials, growth prospects, competitive positioning, and industry trends.

b. Exchange-Traded Funds (ETFs)

Investing in ETFs that focus on the energy sector or specifically target LNG stocks can offer investors a diversified exposure to multiple companies within the industry. These ETFs provide a more convenient way to invest in the sector without the need for extensive research on individual stocks.

7. Conclusion

Investing in liquefied natural gas stocks can be an attractive opportunity for investors looking to benefit from the global shift towards cleaner energy sources. However, it's crucial to conduct thorough research, assess risks, and stay updated on industry developments before making any investment decisions. By taking these precautions and understanding the dynamics of the LNG industry, investors can position themselves for potential long-term growth and profitability in this evolving sector.

Remember: Investing involves risks; therefore, it's advisable to consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice.

#what_is_the_lng, #pgscomvn, #pgs_com_vn, #whatisthelng, #what_is_the_lng, #pgscomvn, #pgs_com_vn/

Nhận xét

Đăng nhận xét